What is the best accounting software for charities and faith organisations?

March 2023Looking for the best faith organisation or charity accounting software in the UK? Discover the right solution for you in this handy guide.

Accounting software has developed significantly over the past decade, helping businesses streamline processes with improved automation capabilities. But what about non-profit organisations?With strict and specific accounting policies to consider, charities and religious groups require a different solution. To shed some light on this challenge, we’ve included the ins and outs of the best accounting software for charities and faith organisations. Let’s explore.

How to choose the right accounting software for your charity or faith organisation

With such a demand, the accounting software market boasts an 8.5% CAGR (2023 -2028) and an overall value of $38.08 billion by 2030. So, before choosing accounting software fit for your purposes, it’s well worth considering whether it can manage the crucial aspects of your organisation.

The ideal accounting software for charities and faith organisations will include the following features:

- Tracking Gift Aid, donations, and overall expenses

- Fund accounting or restricted funds

- The ability to compile reports and generate invoices

- Payroll management capabilities

- Receipt scanning and bank feed capabilities

For example, charities must guarantee that any money raised is spent only on the specific purpose of its intention. But with the right accounting software, charities can achieve this necessity with minimal complications and automated processes.

The 4 best accounting software for charities and faith organisations in the UK

Here are four of the best charity accounting software solutions available to your organisation in the UK.1. QuickBooks Online

Ideal for remote workforces and volunteers, as a cloud-based software product, QuickBooks allows you to manage your accounts anywhere with an internet connection. QuickBooks is notoriously easy to use and accurately tracks income and expenses while producing financial reports.

Here are some specific QuickBooks advantages and disadvantages:

Advantages

• Quickly establishes custom reports for specific purposes.

As one of the leading accounting software products in the UK, Xero enables charities and religious groups to save time and money with simple accounting and intuitive user experience (UX) capabilities. Here are a few benefits and limitations of Xero in more detail:

Advantages

• Additional apps and features are available for fundraising, donor management and marketing.

• You can manage all aspects of your organisation on one platform.

• No downloads or installation is necessary due to being a cloud-based product.

Disadvantages

• Unlike other accounting software, Xero is more difficult to use and understand.

• It no longer includes built-in payroll and debt chaser features.

• Requisition, purchase and inventory aspects are basic.

Pricing

• £12 per month (Starter – 20 invoices and five bills)

• £26 per month (Standard – Unlimited bills, invoices and cashflow)

• £33 per month (Premium – The standard perks but in multiple currencies)

As cloud-based software, Xero supports thousands of companies but lacks certain aspects that your organisation may require. Ensure you do your research before deciding to invest.

3. Sage

Sage is a popular choice for multiple UK non-profit organisations by allowing you to manage finances efficiently and effectively at a 50% rate. Here are the pros and cons if you opt for Sage as your accounting software provider:

Advantages

• Offers a free trial so you can try before you buy and a 50% price reduction for all registered UK charities.

• It generates in-depth reporting across multiple financial features.

• Provides numerous customisation possibilities with budgeting and cash flow forecasting capabilities.

Disadvantages

• It’s challenging and time-consuming to set up.

• It requires training from a Sage expert to use it effectively.

• It can appear over-complicated with too many features.

Pricing

• £6 per month for UK charities (Starter – Normally £12)

• £12 per month (Standard – Normally £24)

Sage offers more features and in-depth reporting than your standard accounting software. But it can appear overcomplicated and requires training staff.

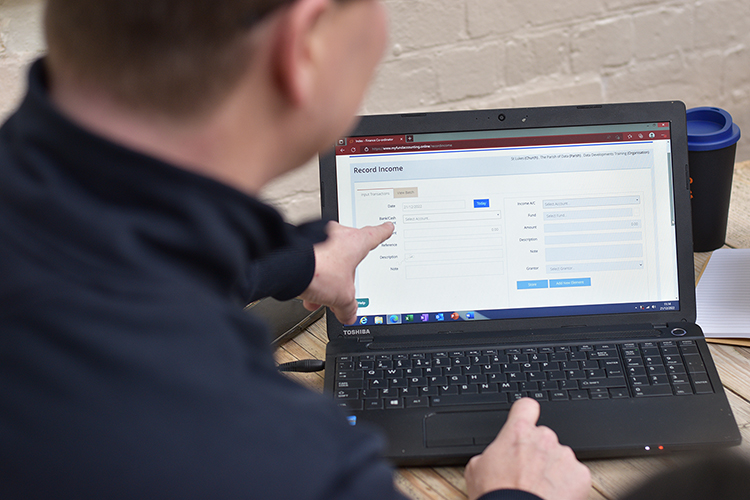

4. MyFundAccounting.

Online Based on the same system structure as Finance Co-Ordinator, MyFundAccounting. Online is designed specifically with charities and faith organisations in mind. MyFundAccounting. Online is created to manage the accounts of charities and religious groups with reports produced in compliance with The Charity Commission and OSCR requirements.

Here are a few of MyFundAccounting.Online benefits for your organisation:

• Unlimited funds and nominal accounts, including income, expenditure, and current assets.

• Easily edit and void transactions.

• Create memorised and template transactions with budgets and analytics features.

• You can export reports and data to various formats, such as Word, Excel, PDF, etc. Pricing

• £15 per month (£4 per additional licence)

With complete control capabilities and unlimited user access on the platform, MyFundAccounting. Online provides a superior charity accounting solution designed especially for non-profit organisations.

Speak to Data Developments for your ideal accounting software solution

Data Developments has been writing and developing software for charities and religious groups for the past 35 years.With industry experts on hand, we ensure all our software solutions meet compliance and offer high performance for non-profit organisations. Our software products are approved by Dioceses in the Church of England, Church of Ireland, Church of Scotland, Dioceses in the Roman Catholic Church in England and many more. So, if you’re looking for accounting software designed with your organisation in mind, get in touch with Data Developments today.

More News

Data Developments’ 40th Anniversary – MyRollcall

June 2025As of this year, Data Developments has officially written and developed accounting software for churches and charities for 40 years. Since our founding, we’ve created products and services that make accounting and administration easier for real people in everyday situations.

Most of our customers will be aware of our desktop application ‘Membership Co-ordinator’ and its online application counterpart ‘MyMembershipManager’. But did you know that this product once went under a different name? Or that it was the program that started it all?

Getting started with your charity accounts requirements

March 2024Make your charity accounting requirements much more simple with this handy beginners guide. From defining your legal structure to calculating your annual income and trustee’s annual report, we’ve got you covered.

We should expect transparency and accountability across all charity work, especially when it comes to its accounting and financial reporting.

But without knowing the correct methods and navigating the necessary regulations by the book, how can you ensure you satisfy legal procedures while maintaining your organisation's reputation?

In this blog, we’ve broken down charity account requirements with an easy beginners' guide so you can get the ball rolling on your accounting without too much trouble.